The Bank of England has announced plans to restrict the ownership of stablecoins, a type of cryptocurrency pegged to the value of hard fiat currency, such as pounds or dollars, by maintaining equal value between the two. This might sound like a sensible move from the central bank in light of what we do (and don’t) know about crypto, but it is liable to backfire.

Stablecoins have become increasingly popular as a more reliable type of cryptocurrency allowing users to transfer funds across borders much more quickly and cheaply than traditional banks. At the moment, they only account for less than 1% of global money flows, but many analysts expect the uptake of stablecoins to accelerate in the years ahead.

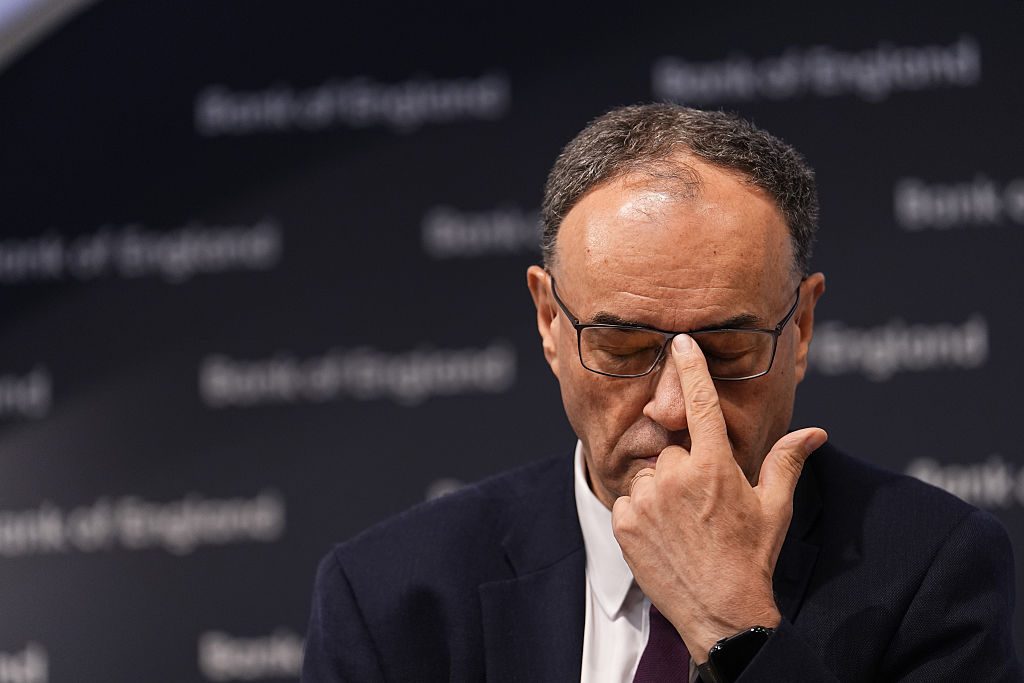

However, the Bank of England has proposed imposing stablecoin ownership limits of between £10,000 and £20,000 for individuals, as well as £10 million on businesses. The idea that the authorities should seek to limit ownership of any financial asset is a clear case of overreach. It would be unthinkable for regulators or the Government to limit the amount of cash somebody could hold, for example, or to place restrictions on the number of stocks individuals could invest in.

There is risk involved in using cryptocurrencies, of course, but that is a risk for individuals and businesses to assess for themselves. What happened to the City’s defining mantra of caveat emptor: let the buyer beware?

The Bank of England has justified these proposals on the grounds that the widespread use of stablecoins could undermine the banking system by reducing the number of deposits and amount of capital in the system, yet this is a deeply anti-competitive stance. The global banking system has demonstrated myriad weaknesses in recent decades; if a better system is being developed — one that is cheaper, faster, and more efficient — then consumers should have the choice to use it if they wish to do so. Even ignoring the fact that these limits would be almost impossible to enforce in practice, the central bank’s job is not to protect the sector from external competition or stifle potential alternatives at birth.

There is a broader point, too, about the City’s standing in the world. London is already struggling to attract business: in the first half of this year, listings plummeted to a 30-year low, raising a total of just £160 million. Even in the same period in 2009, just after the financial crash, £222 million was raised.

At a time when London’s status as a financial hub is clearly under serious threat, the Bank of England should not be placing stringent restrictions on such a significant emerging industry. The Trump administration has already established America’s first federal legislation on digital assets, as well as a regulatory framework for stablecoins — a move the White House says “makes America the undisputed leader in digital assets”.

While further behind the US in promoting stablecoin use, the European Union — as well as other major jurisdictions — has not sought to place restrictions on ownership. Although crypto undeniably brings risks which need to be managed, the Bank of England’s heavy-handed intervention will likely result in London simply losing even more business.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe