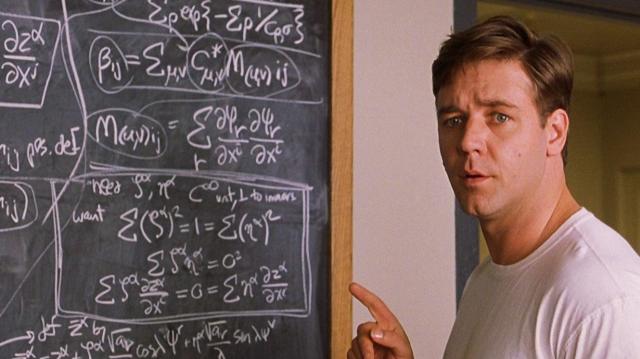

John Nash, as played by Russell Crowe in A Beautiful Mind, had a theory about collusion. Credit: DreamWorks Pictures

Turf wars are bad for business. The Mob understands that, and businesses do as well. Many industries have carved up the US like the Mob divided turf between families in the 1930s. It doesn’t matter where you look, competition looks fierce on paper but in reality it is often carefully orchestrated. This is nothing new. As early as the 18thCentury, Adam Smith wrote in The Wealth of Nations that, “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

When Americans think of businessmen getting together to fix prices, they generally think of Matt Damon in The Informant. The movie tells the story of Mark Whiteacre, the highest-level corporate mole in FBI history, who helped break the Archer Daniel Midland (ADM) lysine price fixing scandal. ADM never met a price it didn’t want to fix. Like a Mob family, they met with competitors to restrict Lysine, an essential amino acid, as well as citric acid and high fructose corn syrup. In a document that came to light in court, an ADM executive wrote, “Our competitors are our friends. Our customers are the enemy.”

ADM were no outliers, either – the estimated annual cost of price fixing by cartels is up to $600 billion worldwide. And collusion doesn’t even need to be so explicit. In fact, you don’t need for players to talk to each other at all to get collusion. Many firms that have been caught continue to collude even after they no longer speak to each other. Tacit collusion can lead oligopolistic firms to achieve monopolistic outcomes, leading to reduced output, higher prices, and lower consumer welfare. This is known as the ‘oligopoly problem’. By allowing extreme industry concentration, the government has essentially guaranteed oligopolies can act like monopolies and encouraged outright and tacit collusion.

This unusual phenomenon can be explained by an idea known as game theory, which can be applied to almost any interaction. Everyone has seen A Beautiful Mind, in which John Nash, played by Russell Crowe, has an epiphany at a bar with his friends as they are trying to pick up women.

There is a group of women: one blonde and a few brunettes. All the men want the blonde woman, and one of Nash’s friends remarked that Adam Smith would have encouraged competition, and the best strategy would be for them to all go and speak to her. But, Nash points out, this would be a really dumb strategy. If they did that, none of them would get the girl. She would feel pressured and then the others would be offended that they were the second choice. The optimal strategy is for the group to cooperate — no one talks to the blonde and instead they all talk to the less attractive friends.

Nash’s key idea was that among different players, they might all choose tacit cooperation rather than face competition. The solution to the problem of competition is called “Nash Equilibrium”.

Nash didn’t create game theory, but he developed it. His idea was a direct descendant of John von Neumann’s Minimax theory. The idea is that players of a game won’t seek to achieve the highest pay-out but will try to minimize their maximum loss. The easiest way to understand this is the example of a parent who allows their two children to divide a cake. The most equal division will happen if one cuts the cake and the other chooses the first piece. Each kid doesn’t seek a theoretical bigger piece – he tries to minimise the chance he ends up with a really small one. Firms will often collude to avoid competition and minimise their maximum loss. That’s what Nash was describing in the film with the blonde.

But there is much more to game theory than talking to a blonde or dividing a cake.

The most famous example is The Prisoner’s Dilemma. If two prisoners are caught by the police and interrogated separately, they each have a difficult choice to make: to snitch or not to snitch. If they both stay silent and don’t rat on each other, they will both achieve the optimal outcome. However, if one of them wants to improve his own lot, he might talk to the police and betray his friend. He might walk, and his friend will serve a longer sentence.

There is no right answer to the Prisoner’s Dilemma. If you only play the game once, you are highly motivated to betray your partner. However, completely different solutions begin to emerge if you play the game many times.

In 1984 Robert Axelrod invited mathematicians, economists, and computer scientists to submit strategies for playing Prisoners’ Dilemma. What he found surprised him.

Strategies in the competition could either cooperate with each other or try to punish each other, but rather than play once, they had to play repeatedly until a victor emerged. The computer programs could not speak to each other or know each other’s intentions. All they could do was observe what the other program did in the previous games. Most strategies were sneaky and tried to get away with punishing their partners any chance they got. Other strategies economists submitted were very complicated with all sorts of rules for cheating or cooperating.

It was completely counterintuitive, but none of the complicated strategies won. The simplest, least elaborate strategy emerged victorious; the strategy was Tit for Tat. If the opponent cheated, Tit for Tat cheated. If the opponent cooperated, Tit for Tat cooperated. It was that simple. The program generally elicited cooperation, yet if others cheated, it punished the opponents and didn’t let them take advantage of Tit for Tat’s kindness.

If you only play one game, punishing your partner might make sense. You can get away with it once. But if you’re in a repeated game, things work differently. The dominant strategy of any iterated interaction is Tit for Tat, which leads to cooperation.

The lessons from Tit for Tat for industries is that if you’re in a cozy enough industry with very few players, selling to the same customers day in and day out over many years, the optimal strategy is always to cooperate.

Most industries are involved in repeated ‘games’ where they can observe their competitors’ actions, and much like the strategy Tit for Tat they have an incentive to cooperate the greater the number of interactions they have. They know competition can be punished in the future with price wars, and they know that tacit collusion can lead to higher margins.

For decades Anheuser-Busch got its rivals to cooperate by not lowering prices. Generally, everyone else followed, and if they didn’t, Anheuser-Busch played Tit for Tat. They signalled to competitors that if they lowered their prices, they’d start an ugly price war. In 1988 Miller and Coors lowered prices on their main beers. In response Anheuser-Busch slashed prices on their key beers. As August Busch III said, “We don’t want to start a blood bath, but whatever the competition wants to do, we’ll do.” Miller and Coors very quickly dropped their price cuts.

Winning everything through competition sounds great, but it is even better not to lose everything.

Academic research on tacit collusion in oligopolies shows that in highly concentrated markets, firms will often coordinate their behaviour simply by observing and reacting to their competitors’ moves. This often leads parallel price movements, and the results that you would associate with a traditional agreement to set prices, output levels, or other conditions of trade. In the US a wide variety of industries are now oligopolistic, which makes tacit collusion easy.

In the corporate world, this is common knowledge. Hermann Simon is a recognised consultant and has worked for decades with companies on their pricing strategies. He wrote a book titled Confessions of the Pricing Man that explained how firms could increase their pricing and get around antitrust laws and competition policy. Simon recognised the easiest way to fix prices would be to speak to competitors but noted that is illegal. Instead, he suggested following a “price leader” and signalling to the market.

Companies in the US car market practiced exactly such price leadership for decades, with General Motors setting price increases. The largest company in most duopolies and oligopolies functions as the price leader, and other companies tend to follow price increases in lock step. These moves are almost never prosecuted.

Another frequent method that companies use is price signalling where CEOs will indicate to the market their desired price hikes to see what the reaction is from competitors. Before any planned hike, a company sends ‘signals’ to the marketplace. Then the company can listen to whether competitors, investors, or regulators send signals back. Simon helpfully explained that, “Signalling is not illegal per se. As long as companies keep their communication relevant to everyone in the marketplace, including customers and investors, and do not go overboard, they are usually on the safe side.”

Just in case these informal methods of price fixing encountered problems, Simon advised, “Please always discuss any application of these approaches with your legal department or advisors to make sure that your company’s policies comply with the law.”

Despite 15 price increase announcements and numerous supply reductions by paper companies over six and a half years, in August 2017 the courts decided in favour of six containerboard companies: Georgia-Pacific, Westrock, International Paper Company, Temple-Inland Inc, and Weyerhaeuser Company. The court ruled that it was not a violation of antitrust law for a firm to raise its price, hoping its competitors would do the same. The containerboard companies bet on a follow-the-leader strategy and that ‘gamble paid off’.

Proof that in business, tacit collusion is rarely punished.

This is the first of three extracts from “The Myth of Capitalism: Monopolies and the Death of Competiton” a new book co-authored by Jonathan Tepper and Denise Hearn

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe