Prime Minister Theresa May, Chancellor Philip Hammond and Communities Secretary Sajid Javid visit a home purchased using Help to Buy. Credit: Hannah McKay/PA Archive/PA Images

“It is essential to have not only more houses, but more houses of the required type in the right place. There are technical difficulties that have to be overcome over land, financing and the organisation of the building industry. But there is also the question of will. Housing has not yet achieved the place of priority in official policy justified both by the social suffering involved and by the public concern that has been aroused”.[1. ‘The Housing Anguish’, The Times, 22 December 1969]

These words appeared in an editorial in The Times in 1969. That year, 378,320 homes were built across the UK. The net annual increase in new dwellings was slightly lower, given that post-war demolition and slum clearance was still going on in to the early-70s. But the rate at which homes became available in 1969 was still a long way ahead of household formation, which then averaged around 160,000 per annum.[2. Chapter 2: Households and Families, ‘Social Trends 39’, 2009]

The current situation could hardly be more different. Official figures show 178,450 homes were completed across the UK during 2016/17 –less than half the 1969 total.[3. See MCHLG live table 209 https://www.gov.uk/government/statistical-data-sets/live-tables-on-house-building] Yet around 275,000 new households are now formed each year, 70% more than in the late 60s. Instead of the supply of new homes outpacing demand, as when The Times published its editorial, the opposite is now true – and has been since the early 1990s.

Successive governments have repeatedly emphasised housing as a priority. Yet when Dominic Raab became Housing Minister in January 2018, he was the 16th person to hold that position in under 20 years.[4. Tony Blair appointed Hilary Armstrong as Housing Minister (1997 to 1999), then Nick Raynsford (1999-2001), Charles Falconer (2001-02), Jeff Rooker (2002-03), Keith Hill (2003-05) and Yvette Cooper (2005-07). Gordon Brown’s Housing Ministers were Caroline Flint (2007-08), Margaret Beckett (2008-09) and John Healy (2009-10). David Cameron appointed Grant Schapps (2010-12), Mark Prisk (2012-13), Kris Hopkins (2013-14) and Brandon Lewis (2014-16). Theresa May then appointed Gavin Barwell (2016-17), Alok Sharma (2017-18) and now Dominic Raab] Of enormous importance to voters, and the source of increasing social division and discontent, the sector has been denied the consistent leadership needed to drive policies that might deliver significantly more homes.

During 2010-2016, when David Cameron was Prime Minister, 141,132 homes were built each year. Under Tony Blair from 1997, and then Gordon Brown, this annual average was respectively 35% and 29% higher, but still far too low. Since the mid-1980s in fact, building has fallen way short of the 245,000 new homes needed annually to meet the natural growth of demand and keep prices affordable.[5. Kate Barker, ‘Review of House Supply – Delivering Stability: Securing our Future Housing Needs’ HM Treasury, 2004]

Ahead of the 2015 election, Cameron said one million new homes would be built by 2020, an average of 200,000 a year over a five-year Parliament. But it was never clear if this was a target or an “aspiration”. Labour leader Jeremy Corbyn has also set a million-home target over five years – with half as social housing.

Since taking office in 2016, Theresa May has rhetorically upped the ante. Initially, her Housing White Paper of February 2017 contained no home-building target.[6. ‘Fixing our Broken Housing Market’, DHCLG, February 2017] But as affordability continued to get worse, the Tory manifesto ahead of the June 2017 election restored the promise to “deliver one million homes by the end of 2020” and “half a million more by the end of 2022”.[7. Conservative Party Manifesto, ‘Forward Together: Our Plan for a Stronger Britain and a Prosperous Future’, 2017] The subsequent Queen’s Speech also pledged to “promote fairness and transparency in the housing market and help ensure more homes are built”.

Philip Hammond’s November 2017 budget appeared to strengthen this pledge. While rejecting demands by Communities Secretary Sajid Javid for £50 billion of public cash to finance house building, the Chancellor targeted “300,000 a year by the middle of the next decade”. [8. ‘Budget 2017: Hammond pledges to fix UK housing market’ Financial Times, 22 November 2017] Apart from making promises but missing home-building targets, have government policies implemented since 2010 eased the UK’s housing shortage?

Juicing-up demand

“I’d argue quite strongly that most of our housing problems have their origins in supply or rather a lack of supply – that’s what my economics training tells me when I see prices rising in the face of rising demand.” These are the words of a very senior Whitehall official, written in early 2018. “This under-supply of housing has made it less affordable, increasing the number of concealed households and contributing to declining home ownership rates.”[9. Internal unpublished Whitehall memo, obtained by author]

Ministers have long been advised the roots of the UK’s chronic housing shortage lie in the “supply side” – with developers failing to build enough homes, either due to a lack of planning permission or, more recently, a tendency to restrict new supply to keep prices, and profitability per unit, high. Yet, since 2010, as affordability issues have become particularly acute, successive governments have taken “demand-side” measures – arguably boosting prices even more.

Since 2013, “Help to Buy” (HTB) has allowed a limited number of homes to be purchased with just a 5% deposit and a low-interest government equity loan worth up to 20% of the purchase price. When chancellor, George Osborne launched the scheme for first-time buyers (FTBs) and others looking to move, with loans applicable only on new-build homes priced below £600,000.[10. HTB loans are interest-free for the first five years. The £600,000 price limit applies to England. In Wales, it is £300,000 and in Scotland the maximum has varied depending on when an application was made. The 20% share was later raised to 40% in London. A “mortgage guarantee” was also introduced, with the government (i.e. taxpayers) acting as partial guarantor on a limited number of home loans. That guarantee scheme was discontinued in 2016.]

The danger is that demand-side initiatives merely subsidise buyers to afford high prices – and for a temporary period. That generates favorable short-term headlines but does little to increase house-building over the long-term. As HTB was being introduced Sir Stephen Nickell, a distinguished economics professor and senior Office for Budget Responsibility (OBR) official, was asked for his view. “Is it just going to drive up house prices? By and large, in the short run, yes,” Sir Stephen told the Treasury Select Committee. “In the medium term will the increased house prices stimulate more house building? A bit, but the historical evidence suggests not very much”.[11. ‘Financial experts question Help to buy claims’ Inside Housing, 2013. A former member of the Bank of England’s Monetary Policy Committee, Nickell was also the first Chair of the government’s National Housing and Planning Authority Advice Unit, set up in June 2007 in response to the Barker Review.]

In 2016, three years after HTB was introduced, a government-commissioned study argued it had generated a 14% rise in annual house building – well short of the significant uplift needed.[12. Stephen Finlay, Peter Williams and Christine Whitehead, Evaluation of the Help to Buy Equity Loan Scheme, DCLG, 2016] The government’s flagship housing policy was otherwise slammed by a range of credible analysts. The Adam Smith Institute, a free-market think-tank, compared HTB to “throwing petrol onto a bonfire…adding more demand without improving supply just raises prices, making homes more unaffordable for people who don’t qualify for the subsidy”.[13. ‘Help to buy won’t build the young any houses’, Adam Smith Institute, 1 October 2017]

The respected housing charity Shelter was similarly critical:

“HTB has completely missed the mark, doing barely anything to help first-time buyers, and nothing to help those most in need of an affordable home. By inflating house prices and subsidising huge corporate payouts it is actually making matters worse.”[12. Shelter CEO Polly Neate, quoted in The Independent, 13 January 2018]

There are legitimate concerns that the main impact of HTB, rather than helping young adults buy a home, has been to strengthen the powerful developers who already dominate the UK house building industry. In 2014, half the homes bought under HTB were sold by the UK’s five largest house builders.[13. Tom Archer and Ian Cole, Profits Before Volume? Major House Builders and the Crisis of Housing Supply, Sheffield Hallam University Centre for Regional Economic and Social Research, October 2016] HTB sales constituted 53% of all Taylor Wimpey homes in 2014, helping generate a 54% increase in profits, to £481 million.[14. Taylor Wimpey PLC, ‘Creating Sustainable Value’, 2014 ] The scheme drove 40% of Persimmon sales that year and 57% by 2016. Some 31% of Barratt homes were sold under HTB in 2014, rising to 44% two years later. Shelter concluded, meanwhile, that HTB added 3% to UK-wide house prices in a single year.[15. How much help is Help to Buy: Help to Buy and the impact on house prices, Shelter, 2015]

From 2013 to mid-2017, 135,000 homes were sold under HTB. There is evidence the scheme, instead of helping FTBs, instead channeled hundreds of millions of pounds of public subsidy to thousands of very wealthy buyers who already owned a home.[16. An analysis of government figures in 2018 suggested that over 5,500 homeowners earning above £100,000 a year had benefitted from taxpayer-funded HTB loans. See ‘Wealthy homeowners received millions in public money under Government scheme to help first-time buyers’, The Independent, 13 January 2018] An even bigger worry is that 32,266 HTB homes, or almost 25%, have been sold leasehold – with the buyer not owning the property outright, but paying the freeholder an annual ground rent.

While flats are traditionally sold with a lease, with a charge made for servicing and maintenance of communal areas, leases on new homes were considered a thing of the past. Yet almost a fifth of houses purchased under HTB in 2017 were sold leasehold. There is growing outrage that large developers have been marketing new HTB houses with contract clauses allowing ground rents to rise dramatically in later years, before selling these leases on to investors at huge profit.

Campaigners say young families are “trapped as prisoners” in homes with escalating ground rent bills, that then become difficult to sell – not least as mortgage providers often won’t lend against them. An estimated 100,000 families now live in leasehold properties with spiralling ground rents, a number that has lately soared due to HTB.[16. This figure comes from the Leasehold Knowledge Partnership, part of the House of Commons All-party Parliamentary Group on Leasehold Reform. The LKP reports homebuyers being charged up to £100 to have a letter answered by the freeholder, with others being billed for thousands of pounds for permission to build a simple extension. Seven out of ten buyers of recently built leasehold homes, many of whom are young with little or no business experience, say they used conveyance solicitors recommended by the developer and the risks were not drawn to their attention. The sale of HTB leasehold homes is now the subject of multiple legal actions.]

Despite all these concerns, the Prime Minister unveiled another £10 billion of HTB funding in October 2017, similar to the amount spent since 2013. Immediately after May’s announcement, the UK’s biggest house-builders added well over £1 billion to their stock market value in a single day –illustrating the extent to which HTB has been a cash bonanza for already powerful developers.[17. ‘Help to Buy adds £1bn to house-builder valuations’, Financial Times, 2 October 2017]

Since HTB began, UK Finance (previously the Council of Mortgage Lenders) estimates it has helped 9.6% of all FTBs. Evidence suggests that the 91% of those it hasn’t helped have faced higher prices.

The Government’s other main demand-side measures have related to stamp duty. In December 2014, Chancellor Osborne rationalised the stamp duty regime, so those buying homes worth under around one million pounds paid less, with higher bills for buyers of top-end homes. The following year, he imposed a 3% stamp duty surcharge on purchases of rental properties or second homes, which again probably helped FTBs to some degree – although buy-to-let lending remained steady, at about £8 billion a quarter both before and after this change.

The most eye-catching move, though, was in November 2017, when Philip Hammond abolished stamp duty altogether for FTBs on homes under £300,000. Just months after Labour came within a whisker of power, thanks to support from younger voters, the Chancellor received positive headlines for helping FTBs get on the housing ladder. The danger remains, though, that without a very significant rise in new homes built, the main impact will be on prices. “This measure is expected to increase house prices,” said the OBR in its budget commentary, ascribing Hammond’s policy a “high uncertainty rating”.[18. ‘Eye-catching stamp duty cut will do nothing to solve our housing crisis,’ Telegraph, 23.11.17. The OBR was similarly unimpressed with an earlier demand-side attempt to help FTBs. In 2016, Osborne introduced a “lifetime ISA”, enabling under-40s to save for a home deposit alongside a pension, with the government offering a 25% top up, to a £4000 annual limit, on savings used to buy a home. “We think {the lifetime ISA} is more likely than not to lead to higher demand for the relatively fixed supply of UK housing, and so to higher prices,” said the OBR’s budget-day fine print.]

The Government’s demand-side policies appear to have boosted prices more than home ownership – worsening affordability, particularly for FTBs. New research from the Institute for Fiscal Studies suggests “pricing-out” has become more acute not just since the 2008 financial crisis, but particularly since HTB was introduced. Just 25% of those born in the late-1980s owned their own home by the time they turned 27, says the IFS – covering the years 2013 to 2017. By that age, 33% of those born in the early 1980s and 43% of those born in the early 1970s were home owners.[19. ‘The decline of homeownership among young adults’, IFS Briefing Note BN224, February 2018]

Supply Go-Slow

What, then, has the Government done to increase the actual supply of homes since 2010? The National Planning Policy Framework (NPPF), which simplified planning guidance from 2012 – introducing the presumption “in favour of sustainable development” – has certainly led to more planning permissions being given.

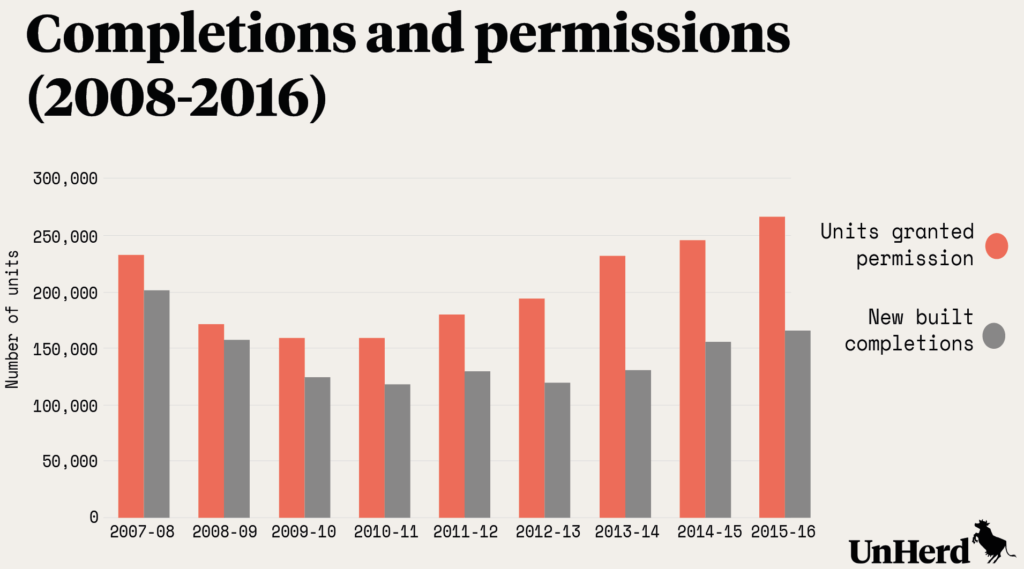

Around 150,000 housing units were granted permission in 2011, rising to over 260,000 in 2016. What’s clear, though, is that housing completions have risen by less than permissions, with “build out” delays getting longer.

In early 2012, before NPPF began, official internal data showed planning permission being granted at an annual rate of 186,170, with some 118,520 homes being completed per annum. The latest data, for early 2017, indicates 303,901 permissions granted annually, 63% up on 2012. Home completions, however, were just 148,240, up only 25%.[20. This paragraph is based on internal MHCLG estimates based on Glenigan and Barbour ABI planning pipeline data]

An authoritative 2013 survey reported that once detailed planning permission had been granted, developers took an average of 1.7 years to start and complete homes.[21. ‘An analysis of unimplemented planning permission for residential dwellings’, Local Government Association, October 2013] By 2017, an industry study revealed a delay of “at least four years on average” from detailed planning permission to completion – a 2.4-fold increase over just four years.[22. See ‘The role of land pipelines in the UK house-building process’, Chamberlain Walker, September 2017]

The growing build-out delay, then, is large and undeniable. It has happened while house prices have risen steadily and immigration has increased sharply – pointing to ample labour supply for construction. Over the same period, though, the UK house-building industry has become far more concentrated, with the eight largest builders now accounting for over half of all new homes each year, as outlined in Part III of Home Truths.

What we have seen since 2012 could easily be interpreted as “contrived scarcity”.[23. I owe this phrase to Guy Standing, The Corruption of Capitalism: Why Rentiers Thrive and Work does not Pay, London: Biteback, 2016: “Scarcity may be natural, as in the case of the truffle, because demand outstrips nature’s bounty, or because there are physical constraints on production or exploitation. But in modern capitalism, scarcity is more often contrived, because a minority possesses all or most of an asset, because rules make it hard to produce or sell, or demand is deliberately stoked to outstrip supply”.] While they would deny it, powerful, dominant developers appear to have engineered a deliberate building go-slow to put further upward pressure on prices, so boosting profitability per unit.[24. MHCLG data show that between December 2012 and July 2016, the stock of housing units unbuilt, despite full residential planning permission, increased from 496,445 to 684,000 in England alone – a 38% rise]

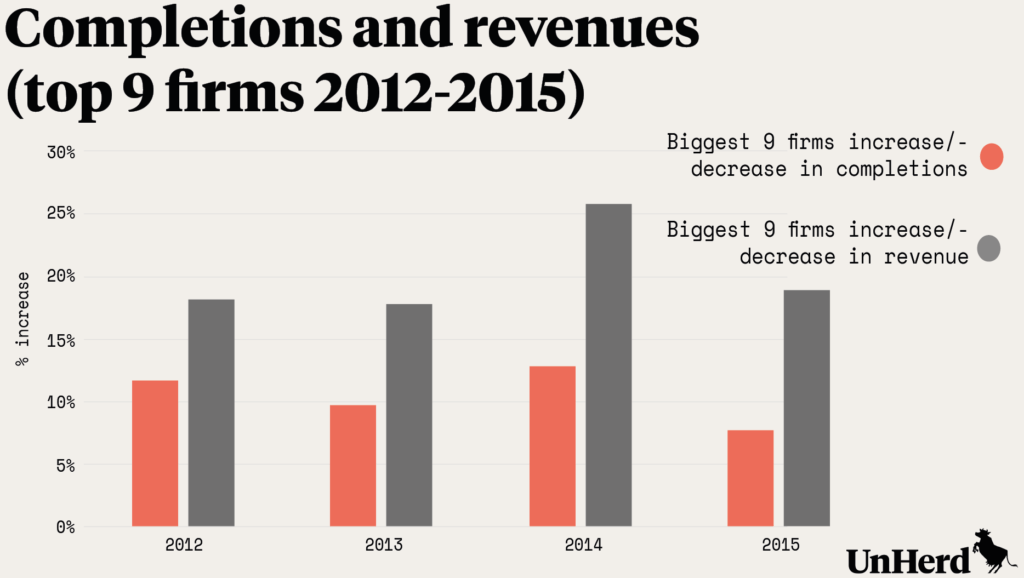

The graph below certainly points to a prioritisation of profit over output. From 2012 to 2015, the number of housing completions by the nine largest UK developers rose 33% but revenues grew no less than 76%. As such, profits ballooned nearly 200%. Over a slightly longer period, from 2010 to 2015, profits at the top five house-builders surged more than five-fold – from £372 million to over £2 billion.[25. Profit figures are before tax and financing costs. See Tom Archer and Ian Cole, ‘Profits Before Volume? Major House Builders and the Crisis of Housing Supply’ Sheffield Hallam University Centre for Regional Economic and Social Research, October 2016]

The “volume” house builders, in particular, have been able to sell homes at a growing premium compared to the average sale prices since 2012 (see graph below). This reflects their domination of high-value localities, given the lack of SME competition, and their overwhelming role in delivering HTB homes.[27. ‘House builders charge premium for Help to Buy properties’, Financial Times, 8 August 2017]

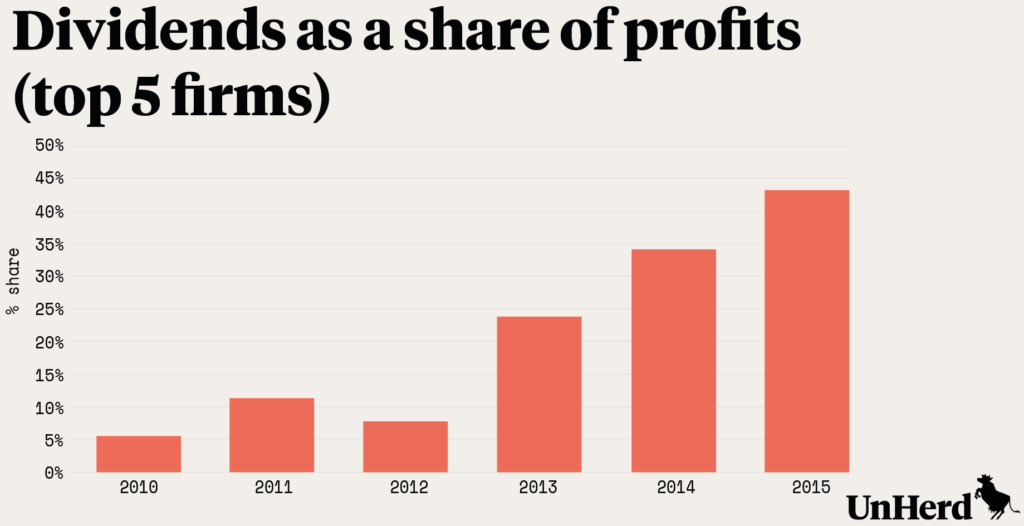

In 2015, the biggest five house builders returned an enormous 43% of their annual profits to shareholders, not less than £936 million. These firms are, to an enormous extent, foregoing the chance to reinvest in order to build more homes. It is rational for firms to maximise profits within the law – the legal obligation, in fact, of senior executives. But the scale of returns at the top of the industry, and the far faster growth of revenue than output – as affordability worsens – points to super-normal profits.

Some ministers have become concerned that the growing concentration of the UK house-building industry is now restricting competition to a degree that is harming consumers and broader society, contributing to the “pricing out” of countless young adults. “The big developers must release their stranglehold on supply,” said Communities Secretary Sajid Javid in October 2016. “It’s time to stop sitting on land banks and delaying build-out – the homebuyers must come first.”[27. Sajid Javid MP, Communities Secretary, Speech to Conservative Party conference, 3 October 2016]

The 2017 Housing White Paper highlighted the “large gap between permissions granted and new homes built”. It pointed to “concern that it may be in the interest of speculators and developers to snap up land for housing and then sit back for a while as prices continue to rise”.[28. ‘Fixing our Broken Housing Market’, DHCLG, February 2017]

Yet despite these words, and the growing dominance of just a few large developers, the government has done nothing to encourage planning permission to be used promptly. Large, cash-rich house-builders and the land promoters described in Part III have every incentive to let permissions lapse, usually after three years, then make fresh applications. They can sit on sites and wait for prices to rise, the gains massively out-weighing re-application costs, as there is no threat or penalty that deters them.

The Ministry of Housing, Communities and Local Government (MHCLG) now estimates up to 40% of permissions granted are allowed to lapse, with 20% never being used at all. As dominant developers and promoters build up permissions, those permits and the land they are linked to remain unavailable for SMEs to build the homes for which there is such strong demand – retaining upward pressure on house prices.

This problem has been clear for several years. Javid’s “stranglehold” intervention eighteen months ago was a watershed moment. A Cabinet minister finally showed something other than deference to the large house-builders, referring to concerns about restrictive practices held by housing campaigners for some time.

Yet, since then, the Government has again kicked this issue into the long grass. In November 2017, the Chancellor announced the “Letwin Review”, to examine “why hundreds of thousands of homes haven’t been built, despite having planning permission”. With an interim report failing to appear at the Spring Budget in March, Letwin is now due to publish in November 2018 – and is expected to offer only analysis, with no policy recommendations.[29. The existence of the Letwin review points to a significant difference of opinion within government regarding the now very high concentration of the UK house-building industry, and the role large developers are playing in making affordability worse.]

Nothing to write home about

Additional supply side reforms since 2010 appear piecemeal and, when it comes to “fixing” the house-building industry, somewhat insignificant. An example is the sale of public land for residential use. The state holds enormous amounts of land, often in very developable places. Transport for London, for instance, owns around 6,000 acres in the capital and Network Rail has substantial landholdings, often close to stations. The NHS, MNCLG, the Ministry of Defence and local councils also have large holdings.

From 1997 to 2010, very little public land was sold for new homes – enough to build an average of only around one thousand units each year. Between 2011 and 2015, though, this improved, with enough public land sold to build 109,500 homes, an annual average of over 27,000.[30. National Audit Office, ‘Disposal of Public land for New Homes’, July 2016]

The reality, however, is that Whitehall is entirely unaware of how many homes have actually been built on land sold since 2011. The Commons Public Accounts Committee was told in 2016 that, despite the 100,000-plus capacity, the number of new homes could be as low as 200.[31. ‘Only 200 houses built on public land that could have held 100,000’ Financial Times, 25 January 2016 ] And, since 2015, public land disposals for home building have sunk once again, to an average capacity of just 9,600 units per year – a major missed opportunity.

Various other supply-side schemes have been announced, including a £3 billion Home Building Fund in 2016. But just £1 billion of this subsidy was targeted at SMEs, with £2 billion directed towards infrastructure and large sites. This seems perverse, seeing as large developers can already access capital. The Accelerated Construction Programme, meanwhile, created a partnership between the government, investors and contractors to target the use of off-site construction and new models of building. Again, this is welcome, but with even rosy government estimates of 15,000 new homes over four years, the scheme is making a meagre contribution towards solving the UK’s affordability crisis.

Another initiative that is yet to deliver relates to brownfield sites. In 2016, the Government legislated to introduce a “zoning-like” system for brownfield land – allowing local authorities to grant “permission in principle” (PiP), a form of advance residential permission on such sites. While this sounds a good idea, at the time of writing, not one local authority has granted PiP for a single unit of housing.[31. A Royal Institute of Town Planning (RITP) survey has raised doubts PiP will spark more house-building as such permissions are still vulnerable to legal reversal by later political and public opposition. RITPs respondents also warned PiP could trigger land speculation, ultimately driving up the price of new homes. See ‘Planning Risk and Development’, RTPI, April 2018]

Following Corbyn’s electoral gains in June 2017, and with Theresa May vowing to take “personal charge of fixing the housing market”, Chancellor Philip Hammond unveiled an eye-catching “£44 billion home-building fund” in November 2017. The package of capital funding, loans and guarantees, added just £630 million to the Home Builders Fund for SMEs. But it added £8 billion of financial guarantees “to support private house-building” seem designed for use, once again, by the “volume” developers.[32. There was also an administrative reorganisation, with Homes and Communities Agency expanding to become Homes England, which Hammond said would “bring together money, expertise and planning and compulsory purchase powers” to deliver news homes.]

Hammond pledged 300,000 new homes a year by the mid-2020s – “the biggest annual increase in housing supply since the 1970s”. The OBR, meanwhile, said it was making no changes for its forecast for new homes based on the Chancellor’s budget policies.

What does not seem to be on the Government’s agenda is one very obvious supply-side policy –measures to encourage a major increase in building by Local Authorities and Housing Associations.[33. While independent, Housing Associations are regulated by the state and often receive public funding. While non-profit, some Housing Associations also issue bonds and/or accept charitable donations – and any trading surpluses are reinvested in building and maintenance. They have their origins in the UK’s mid-nineteenth century philanthropic and voluntary organisations – early examples including Guinness Trust and Peabody Trust. Under the Thatcher government, some councils prevented from subsidising housing directly channeled money to Housing Associations, while permitting social housing tenants to buy their homes at a large discount. Facilitated by the Housing Acts of 1985 and 1986, many local authorities transferred their remaining housing stock to Housing Associations – which are now the main providers of new housing for rent across the UK, while also running shared ownership schemes for those lacking means to buy a home outright.] Over the last two decades, only a few thousand council houses have been built each year, falling to just a few hundred for several years under Tony Blair. And the Grenfell Tower tragedy of June 2017 highlighted the poor quality of much of the UK’s social housing.

Referring to Grenfell in her party conference speech five months later, Theresa May offered, “an extra £2 billion in funding for affordable homes”. Downing Street later confirmed that would pay for around 25,000 new homes, or 5,000 a year over the period the funding would be introduced. This hardly seems an adequate response.

Since 2010, despite granting many more planning permissions, successive governments have failed to incentivise an increasingly concentrated private sector to build faster, while doing little to reinvigorate the social housing sector either. In 2016, the House of Lords Select Committee on Economic Affairs concluded “the government must recognise the inability of the private sector, as currently incentivised, to build the number of homes needed”. The committee argued that without far more new social housing, the UK has no chance of building the homes required over the coming decade and more.[34. ‘Building More Homes’, House of Lords Economic Affairs Select Committee, HL Paper 20, July 2016]

If the UK is to build the 300,000 new homes now required annually, it seems inevitable that around 100,000 units of affordable social housing will be needed each year, to both rent and buy – a three-fold increase.[35. In 2016-17, Housing Associations built 30,180 homes across the UK, while Local Authorities built 2,960]

The Government has recently shown early signs of moving policy in this direction, with May suggesting Housing Association debt might be taken “off the books”, allowing them to borrow more to build in high-demand areas. But these ideas are currently very vague and a long way from fruition. On the basis of the current evidence – not least the structure, organisation and recent performance of major developers – the private sector alone will fail to provide the homes required over the coming decades. The gap between housing demand and supply will continue to grow ever larger. Only radical and disruptive government action will change that.

Read the rest of Liam Halligan’s in-depth investigation of the UK housing crisis, Home Truths.

Join the discussion

Join like minded readers that support our journalism by becoming a paid subscriber

To join the discussion in the comments, become a paid subscriber.

Join like minded readers that support our journalism, read unlimited articles and enjoy other subscriber-only benefits.

Subscribe